阿格拉泰布里安扎(意大利语:Agrate Brianza,意大利中部),2025年5月7日——在Dario Gianandrea Ferrari主持的会议上,莹特丽集团(ICOS.MI)董事会批准了截至 2025 年 3 月 31 日止期间的中期报告。

Agrate Brianza, May 7, 2025 - The Board of Directors of Intercos S.p.A. (ICOS.MI), at today’s meeting chaired by Dario Gianandrea Ferrari, approved the Interim Report for the period ended March 31, 2025.

First Quarter 2025 Group Highlights

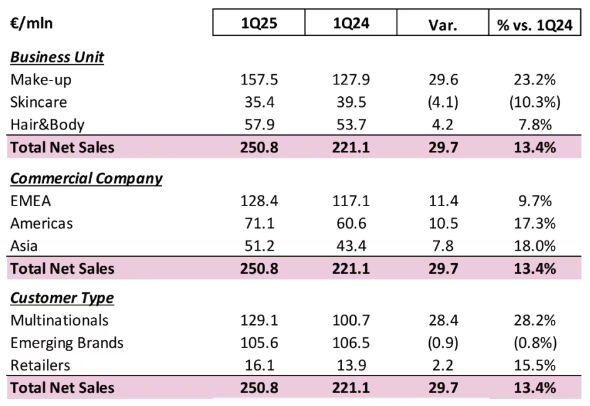

2025 年第一季度,集团净销售额达 2.508 亿欧元,同比增长 13.4%,即增加 2970 万欧元。尽管 2025 年美容市场开局面临挑战,但与上一年度第一季度(受网络攻击事件影响)以及 2023 年第一季度(增长 6.9%)相比,集团仍实现了出色的业绩增长。彩妆板块依然是主要增长动力,这得益于与 2024 年第一季度相比,跨国公司在该板块的业务显著复苏。

Net Sales of €250.8 million in Q1 2025, up +13.4% (+13.1% at constant exchange rates) or +€29.7 million. Despite the challenging start to 2025 for the Beauty market, the Group reports excellent growth both compared to the first quarter of the previous year, impacted by the Cyber-Attack, and compared to the first quarter of 2023 (+6.9%). The Make-up segment was confirmed as the main growth driver, supported by a significant recovery of the Multinationals compared to the first quarter of 2024.

2025 年第一季度,集团经调整后的EBITDA总计达 2930 万欧元,较上年同期增长 40.6%(即增加 840 万欧元)。这一增长不仅得益于出色的销售业绩,还归功于盈利能力的显著提升。与 2024 年第一季度相比,经调整后的 EBITDA 占净销售额的比重提升了2.25%。由此,过去十二个月的累计经调整后 EBITDA 已突破 1.5亿欧元大关。Adjusted EBITDA in the first quarter of 2025 totaled €29.3 million, increasing +40.6% on the previous year (+€8.4 million). Growth was driven not only by the excellent sales performance, but also by a marked improvement in profitability, with EBITDA as a percentage of net sales expanding by +225 basis points compared to the first quarter of 2024. Cumulative Adjusted EBITDA for the last twelve months thus surpassed the €150 million level.

莹特丽集团

CEO Renato Semerari的总结信

“我们对 2025 年第一季度的业绩深感满意。尽管 2025 年初市场环境已然充满挑战,尤其是在美国和中国市场,但我们集团再次彰显了其强大的韧性,与 2024 年第一季度相比,销售额增长了 13%,与 2023 年第一季度相比,也实现了 7% 的增长。尤为值得一提的是,我们核心业务单元——彩妆业务的表现令人欣喜,其销售额增长了 23%,重新占据了集团总销售额的 60% 以上。莹特丽在全球各区域市场均实现了强劲的营收增长,美洲、欧洲、中东和非洲(EMEA)以及亚洲市场均实现了两位数的增长。其中,亚洲市场增长势头尤为强劲,在中国和韩国市场的带动下,增长显著(本季度增长 18%),明显跑赢大市。正如预期,EBITDA也实现了令人瞩目的增长,增幅达 40.6%,至 2930 万欧元,这使得 EBITDA 占净销售额的利润率较 2024 年提升了2.25%。在当前依然复杂的市场环境中,尤其是在美国市场,这些业绩进一步印证了我们对集团发展潜力的乐观预期。订单量持续保持稳健态势,彰显了莹特丽的抗压力与业务实力,而我们在全球各区域市场所开发的创新产品也持续受到客户的青睐,这一点在 Cosmoprof 美容展上客户反馈中得到了充分体现。尽管全球贸易,尤其是美容行业,目前仍面临诸多不确定性,但我们相信,从中长期来看,这将有利于像莹特丽这样在全球范围内拥有均衡布局、且贴近终端市场的生产商。”

“We are very satisfied with the results for the first quarter of 2025. Against already clearly challenging market dynamics at the beginning of 2025, particularly in the US and China, our Group once again demonstrated its ability for resilience, with sales growth both compared to the first quarter of 2024 (+13%) and of 2023 (+7%). In particular, we are very satisfied with the performance of our main Business Unit, Make-up, which thanks to growth of +23% returned to account for more than 60% of overall Group sales. The strong top line growth was also seen across all the regions in which Intercos operates, with the Americas, EMEA and Asia all growing by double-digits. In particular, Asian growth continued to clearly counter the general market, growing significantly (+18% in the quarter) both in China and in Korea. The recovery in EBITDA (+40.6% to Euro 29.3 million), as expected, was also very satisfying, resulting in the EBITDA margin on net sales increasing by 225Bps compared to 2024. Within a still complex market environment, particularly in the United States, these results validate our optimism on our Group’s potential. Orders continue to be robust, confirming Intercos’ resilience, while the renewed interest in the innovative products developed by our Group across all regions in which we operate was confirmed also by the feedback from our customers at the Cosmoprof trade fair. The current uncertainties permeating global trade, not only for the Beauty sector, we believe over the medium-term will favor producers who, like Intercos, have global, well-balanced footprints close to the end markets”.

亚洲地区表现

ASIA REGIONAL PERFORMANCE

亚洲市场持续保持稳健增长态势,在集团合并销售额中的占比已达 20.4%。与 2024 年情况类似,2025 年第一季度,亚洲市场再次实现了两位数的增长(+18%),销售额达到 5120 万欧元。这一业绩主要得益于韩国和中国市场的出色表现。

Asia continued to see sustained growth, coming to account for 20.4% of consolidated Group sales. As in 2024, again in the first quarter of 2025, double-digit growth is reported (+18%), with sales of €51.2 million.The result reflects the excellent performance of Korea and China, thanks to the contribution of the localbrands and the Multinationals operating in both the Make-up and Skincare areas.

展望与指引

Outlook & Guidance

创新始终是我们业务模式的核心所在,也确保了集团在全球美容市场中占据独特地位。在当前市场环境疲软的情况下,这一优势显得尤为重要,因为各品牌正寻求强化其创新产品线,以争夺市场份额。此外,我们集团另一大支柱——产品和地域多元化,如今也承载着更为重大的战略意义。在 Cosmoprof 这一全球最大的美容展会上,集团与客户举行了约 450 场会议。客户们对莹特丽为未来几年所提出的新趋势和配方表现出浓厚兴趣。莹特丽持续开发新的专利和配方,这些研发工作不仅针对全球市场,也兼顾区域市场特性,以满足莹特丽及其客户所在当地市场的需求。面对由关税政策引发的贸易战,莹特丽将凭借其高度的地域多元化优势持续受益。集团在美国设有两家生产工厂,巴西一家,意大利五家,瑞士、波兰、印度各一家,中国四家,韩国一家。这一布局使莹特丽成为全球美容市场中最优的外包选择,能够更高效地为全球客户提供创新产品。我们预计,在当前环境下,集团广泛的地域布局将在中期内为全球美容品牌的供应链提供切实可行的替代方案。这些品牌很可能会加大生产本地化力度,并相应增加外包业务。基于第一季度的业绩和订单接收趋势,集团确认了 2025 年的业绩指引,预计按恒定汇率计算,净销售额将较 2024 年增长 5% 至 7%。

Innovation continues to be central to our business model and ensures our Group's unique position in the global Beauty market. This is of even greater significance within a soft market environment, in which brands seek to strengthen their innovation pipelines to gain market share. Moreover our product and geographic diversification, another pillar of our Group, now assumes even greater strategic importance.

At Cosmoprof, the world's largest Beauty fair, the Group held approximately 450 meetings with customers, who were interested in discovering the new trends and formulations proposed by Intercos for the coming years.Intercos continues to develop new patents and formulations, conceived also at regional level for the local markets in which Intercos and its customers operate.Against a backdrop of trade wars triggered by tariff policies, Intercos will continue to benefit from its high level of geographic diversification. With two production plants in the US, one in Brazil, five in Italy, one in Switzerland, one in Poland, one in India, four in China, and one in South Korea, Intercos is the best outsourcing option in the global Beauty market, being able to provide innovation to customers in a more efficient way all over the World.We expect that, in the current environment, the Group's broad geographic footprint over the medium term will offer viable alternatives for the supply chains of Beauty brands globally, who will most likely increase the localization of production and consequently theirs outsourcing.In light of the first quarter results and order in-take trends, the Group confirms its guidance for 2025, which forecasts an increase in net sales over 2024 in a range of +5% to +7% at constant exchange rates.